Mortgage points significantly impact long-term financial obligations. Differentiate negotiable (origin fee, application costs) from non-negotiable fees. Compare lender offers to secure lower point structures, saving substantial amounts over 30 years. Avoid advertised rates without knowing associated points. Evaluate lenders based on competitive point rates and transparent pricing. Homeowners with excellent credit can secure lower point rates. Active shopping during low-interest rate periods enhances savings. Comparing lender policies is crucial for informed decisions. Navigating market fluctuations using mortgage points protects investments. Refinancing to a lower-interest loan with points could be strategic during declining rates. Assess financial goals and risk tolerance before deciding on mortgage points.

In the intricate financial landscape of homeownership, understanding mortgage points is paramount for any homeowner or aspiring purchaser. These seemingly complex components play a pivotal role in shaping the long-term financial burden and overall ownership experience. The current market dynamics, with their ever-shifting interest rates and loan programs, have made navigating these points even more challenging. This authoritative analysis aims to demystify mortgage points, offering homeowners a comprehensive guide to deciphering and leveraging this critical aspect of their loans. By the end, readers will be equipped with the knowledge to make informed decisions, ensuring they secure the best possible terms for their financial future.

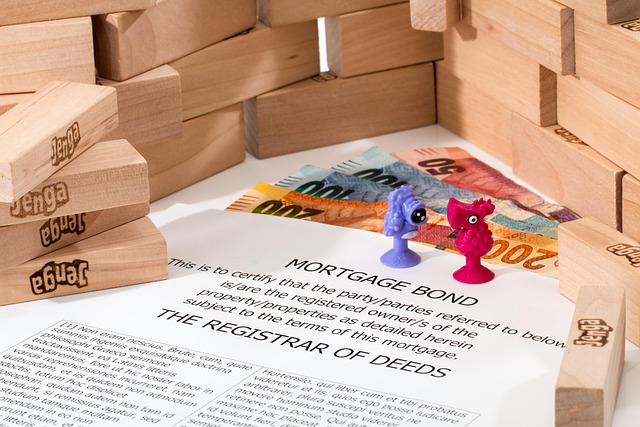

Understanding Mortgage Points: A Comprehensive Guide

Mortgage points, often shrouded in complexity, are a critical aspect of homeownership that can significantly impact long-term financial obligations. These points represent fees paid to lenders at closing, typically as a percentage of the loan amount. Understanding mortgage points is essential for homeowners aiming to make informed decisions and secure the best financing options. A thorough grasp allows borrowers to navigate the market effectively, comparing offers from various lenders and securing favorable terms.

When evaluating mortgage points, it’s crucial to differentiate between those that are negotiable and non-negotiable. Negotiable points include fees like loan origination, application, or closing costs, which can vary widely among lenders. For instance, a 1% discount on the loan origin fee could amount to substantial savings over the life of a 30-year mortgage. Lender comparison is pivotal in this regard; borrowers should shop around for offers with lower point structures. According to recent industry reports, average mortgage rates have been fluctuating, making it even more critical for homeowners to grasp these nuances.

Lenders often advertise enticing rates without revealing the associated mortgage points, which can lead to unanticipated costs at closing. A practical approach involves comparing not just interest rates but also the total point structure. For example, a loan with a slightly higher interest rate but lower points could prove more cost-effective in the long run. As such, borrowers should delve into the specifics of lender offers, scrutinizing both primary and secondary mortgage points. This strategic approach ensures that homeowners secure not only affordable rates but also transparent and competitive financing terms.

Deciphering Components: What Impact Do They Have?

Mortgage points, a key component of home financing, can significantly impact homeowners’ financial journeys. Each point represents one percent of the loan amount, with lenders offering discounts or fees based on creditworthiness and market conditions. Understanding these mortgage points is crucial for making informed decisions during the borrowing process, allowing homeowners to optimize their long-term financial strategies. For instance, a reduction in points can lower initial closing costs, providing more liquidity post-purchase.

When comparing different lenders, examining the associated mortgage points becomes a strategic move. Lender comparison reveals variations in point structures and fees, offering borrowers opportunities to secure more favorable terms. A study by the Federal Reserve showed that shopping around for mortgages can save borrowers hundreds or even thousands of dollars over the life of their loans, emphasizing the importance of careful consideration. For example, a lender charging 1.5 points might offer lower interest rates than one asking for no points but with higher fees elsewhere.

Experts suggest evaluating lenders based on their point structures and transparency in pricing. Some lenders may promote low- or no-point offers, but these could come with higher interest rates. A balanced approach involves selecting a lender that aligns with your financial profile, offering competitive points and transparent fee structures. For instance, homeowners with excellent credit may qualify for lower point rates, saving them substantial amounts over the mortgage term. Staying informed about current market trends and collaborating with reputable lenders can help navigate this intricate aspect of homeownership successfully.

Strategies for Optimal Point Management

Mortgage points, a concept often shrouded in complexity, are a crucial aspect of homeownership that can significantly impact financial stability. These points, which represent fees paid to lenders at closing, are a common feature in various mortgage agreements. However, effective management of these mortgage points is an art many homeowners struggle with. A strategic approach to point management not only minimizes upfront costs but also ensures long-term financial health.

Optimal point management involves a meticulous balance between negotiating with lenders and understanding the broader market dynamics. Homeowners should engage in thorough research, comparing offers from different lenders, particularly focusing on mortgage points as a key differentiator. For instance, a lender offering a lower interest rate but higher mortgage points might not be the most favorable option if it results in substantial long-term savings. The goal is to strike a balance—securing competitive rates while keeping point costs manageable. Recent market trends suggest that borrowers who actively shop around and compare mortgage points can save thousands over the life of their loan.

A practical strategy involves negotiating with lenders, especially when combining multiple services or offering flexible timelines. Some lenders might be open to reducing points in exchange for a larger loan amount or a longer-term commitment. Additionally, keeping an eye on market fluctuations can provide timely opportunities. During periods of low interest rates, borrowers may find more lenders willing to negotiate on points, further enhancing savings potential. Remember, each lender’s policy varies, and comparing these policies is essential before making any decisions. By adopting these strategies, homeowners can navigate the mortgage landscape with greater confidence, ensuring they secure not just a loan, but an affordable and sustainable financial journey.

Navigating Market Fluctuations: Protecting Your Investment

Navigating market fluctuations is a critical aspect of homeownership, as interest rates ebb and flow, impacting the financial landscape for borrowers. Mortgage points, a strategic tool in the arsenal of homeowners, offer a means to protect investments during these volatile periods. These points, essentially pre-paid interest, can significantly influence the overall cost of a mortgage. When market conditions change, especially with rising rates, refinancing becomes a common consideration for many homeowners looking to lock in better terms and save on interest expenses.

One practical approach is to compare mortgage points offered by various lenders. A point is worth approximately 1% of your loan amount, and understanding the point differential between lenders can be substantial over the life of a mortgage. For instance, a 30-year fixed-rate mortgage with 2% interest rate might include 1.5 points, effectively increasing the cost by $1,500 upfront. However, this initial expense could result in savings over time as lower rates are locked in. A thorough lender comparison can help homeowners identify the best value for their money and mitigate the financial impact of market fluctuations.

Moreover, staying informed about economic trends and central bank policies is vital. The Federal Reserve’s decisions on interest rates can directly influence mortgage rates. By anticipating rate changes and acting swiftly, borrowers can refinance at more favorable terms. For example, during periods of declining rates, refinancing to a lower-interest loan with points could be a strategic move. While upfront costs increase, long-term savings may outweigh the initial expense, especially in a low-interest environment. Homeowners should assess their financial goals and tolerance for risk before deciding on mortgage points, ensuring they make informed decisions tailored to their unique circumstances.